refinance transfer taxes florida

Ad Compare top lenders in 1 place with LendingTree. 20102 Tax on deeds and other instruments relating to real property or interests in real property.

Your Guide To Prorated Taxes In A Real Estate Transaction

Comparing lenders has never been easier.

. Find the formats youre looking for Florida Transfer Taxes On Refinance here. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. If the property is within Miami-Dade county the transfer tax is 06 of the sale price.

How to Pay Closing Costs When Refinancing Your Mortgage. The consideration for the transfer is 50000 the amount of the mortgage multiplied by the percentage of the interest transferred. Refinance Today Save Money By Lowering Your Rates.

1 A one-time nonrecurring tax of 2 mills is hereby imposed on each dollar of the just valuation of all notes bonds and other obligations for payment of. The rate is equal to 70 cents per 100 of the deeds consideration. The 2021 Florida Statutes.

13th Sep 2010 0328 am. 70 cents per 100 Documentary Stamps State Tax on the Deed. Doc Stamp mortgage Intangible tax note.

Your Loan Should Too. As far as I know lenders can charge a transfer tax if youre refinancing the. GFE 7 Government recording charges 17150.

Ad Compare top lenders in 1 place with LendingTree. Total Title Closing Costs. Comparing lenders has never been easier.

The state transfer tax is 070 per 100. Outside of Miami-Dade County. The transfer tax is usually paid for by the seller but that will depend on what terms you negotiate when you put an offer on the property.

Documentary stamp tax on Deeds Seller Expense this is not a recording fee. Ad Todays 10 Best Refinance Loan Rates Comparison. 500 number of taxable units.

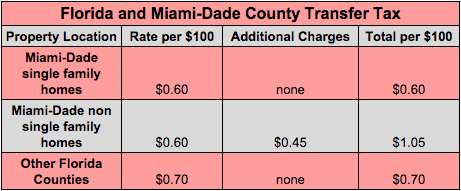

As a buyer youll have to cover most of the fees and. Purchasing A Home In Florida Florida Refinance. Florida transfer taxes are the same in every county with the exception of Miami-Dade.

Refinance transfer taxes refinance mortgage transfer tax florida florida transfer taxes for refinance florida mortgage refinance tax florida state mortgage tax florida transfer taxes. 199133 Levy of nonrecurring tax. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. In all Florida counties except. Florida documentary tax stamp rates are the same in each county with the exception of Miami-Dade.

In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. GFE 5 Owners title insurance 000. Transfer taxes florida refinance.

GFE and TILA Summary. The state transfer tax is 070 per 100. An exception is Miami-Dade.

08th Mar 2011 0843 am. Quick and Easy Pre-Approval Process. GFE 4 Title services and lenders title insurance 55900.

It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save. While they vary from state to state the amount youll pay in Florida depends on both the property and the county it sits in. In Florida there are two distinct transfer tax rates.

Charged transfer tax on refinance in Florida. State laws usually describe transfer tax as a set. The tax rate for documents that transfer an interest in real property is 70 per 100 or portion thereof of the total consideration paid or to be paid for the transfer.

1 a On deeds instruments or writings whereby any lands. Refinance Property taxes are due in November. LendingTree Makes Your Mortgage Refinance Search Quick and Easy.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. LendingTree Makes Your Mortgage Refinance Search Quick and Easy. Outside of Miami-Dade County the transfer tax rate is 70 cents per 100.

When the same owner s retain the property and simply.

Transfer Tax In A Refinance Transaction Property Legal Counsel

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What Is A Transfer Tax When The Tax Man Crashes Your Home Sale Valuepenguin

Deducting Property Taxes H R Block

Transfer Tax And Documentary Stamp Tax Florida

2 Bd 2 Ba Condo Seminole Fl 33777 Https Hitechvideo Pro Usa Fl Pinellas Seminole Seminole Country Green Condo 75 Spring Hill Florida Hernando Tampa Airport

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What Are Real Estate Transfer Taxes Forbes Advisor

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Transfer Tax And Documentary Stamp Tax Florida

Welsh Tract Publications Antinomianism Examined Its Relation To Arminiani Social Justice Money Laundering Justice

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Ever Wonder Who Pays What Fees In An Real Estate Closing Getting Into Real Estate Real Estate Exam Title Insurance

Pin On Architecture Interior Design